Building a Modern Securities Finance Technology Stack

The Securities Lending market, which facilitates lending and borrowing of securities against collateral, is critical to the health of the overall global ecosystem. It’s a major function within prime brokerages, and key to Clear Street’s business. The global Securities Lending market is large — with more than $2.7 trillion in assets on loan as of 2021 and revenue of $5.45 billion, an increase of 19% year over year. (i)

Like clearing and custody on the post-trade side, critical components of the securities finance industry run on decades-old technology. This technology can create friction in the ecosystem, which is where Clear Street comes in. In fact, when our Stock Loan team first started trading, they were using a patchwork of tools that were built at least two decades ago. They were quite outdated and required a ton of manual processing, but the biggest issue was the amount of cognitive overload these systems placed on the traders. Simple tasks required navigating multiple pages of information, negatively impacting efficiency.

About Our Team

I lead Securities Finance engineering at Clear Street. Our team of 14 engineers partners directly with our Securities Finance traders to develop a robust, proprietary technology platform that is cloud-native and horizontally scalable, and we believe will add considerable efficiencies to our business.

My team and I have worked at large broker-dealers in the past, and we’ve experienced firsthand the frustrations with antiquated and inefficient operations. We’re using those lessons to build Clear Street’s Securities Finance stack from scratch, bearing in mind that our strategy has always been to engineer products with building blocks that can be reused in many other contexts.

Building a New System for Locates

Before someone can sell a security short, they need to “locate” the inventory required to place the sell order in the market. A locate is an acknowledgement from the broker — in this case Clear Street — to the customer that there is adequate inventory available to facilitate that short sale.

We knew that with our technology and skillset we could build a state-of-the-art Locates platform that would solve the issues our team and clients were facing. After months of research and development, ATLAS was born.

Faster, More Reliable Locates

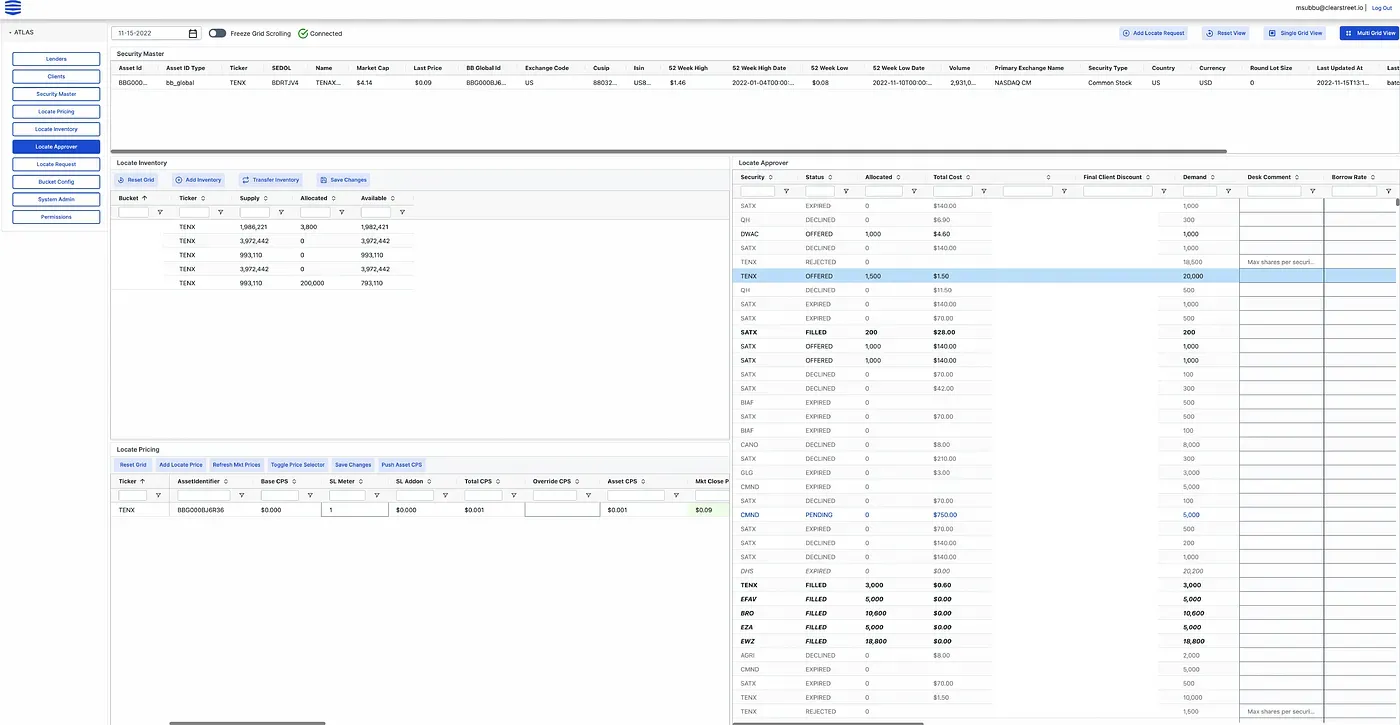

ATLAS (Automated Trading Locates Allocation System) is our proprietary trading system that allocates stock loan inventory to incoming customer requests. Customers can submit locate orders directly from their Order Management System via our FIX interface, or use our web portal. Customers can also use our robust, fully automated ReST API to programmatically submit locate requests, making it ideal for quantitative trading strategies and robo-advisors.

ATLAS maintains a unified view of all incoming locate requests. A locate request is priced in real time based on the security’s various demand and supply characteristics, market events, and inventory availability. ATLAS responds with an offer, and customers have the option to examine the price before accepting. Once the customer accepts our offer, ATLAS decrements the approved locate quantity from availability and the customer is able to enter a short sale order.

Screenshot of ATLAS portal (redacted)

ATLAS remedied the pain points of our original workflow. The new platform is more reliable and provides a modern user experience with better probability of customer requests being satisfied, especially when supply is tight.

Internally, our trading desk is much more efficient in serving our clients than before. The team no longer spends precious time sifting through pages of information manually and they can react to market events in real time. We have started to roll this out to some customers, who are happy with the modern user experience.

At Clear Street, we are completely cloud-native and operate on a modern, secure, and horizontally scalable engineering framework. This allows us to iterate quickly, add new features, and take products to market faster.

Beyond ATLAS

ATLAS, of course, is just one component of our broader mission to reimagine the legacy workflows and silos that are essential to increasing access in the financial markets. Olympus, the broader Clear Street Securities Finance Stack (of which ATLAS is a part) will soon expand to include real-time inventory availability and streaming borrow rates.

We’re also building a marketplace for Stock Loan, which we expect to share more details on in the near future. It’s all part of our plan to modernize the market infrastructure across capital markets, and improve market access for all participants.

To learn more about what we’re building at Clear Street, contact us.

References

(i) S&P Global, Securities Finance H2 2021 Snapshot

Get in touch with our team

Contact usClear Street does not provide investment, legal, regulatory, tax, or compliance advice. Consult professionals in these fields to address your specific circumstances. These materials are: (i) solely an overview of Clear Street’s products and services; (ii) provided for informational purposes only; and (iii) subject to change without notice or obligation to replace any information contained therein. Products and services are offered by Clear Street LLC as a Broker Dealer member FINRA and SIPC and a Futures Commission Merchant registered with the CFTC and member of NFA. Additional information about Clear Street is available on FINRA BrokerCheck, including its Customer Relationship Summary and NFA BASIC | NFA (futures.org). Copyright © 2024 Clear Street LLC. All rights reserved. Clear Street and the Shield Logo are Registered Trademarks of Clear Street LLC