Preparing for T+1 and Beyond

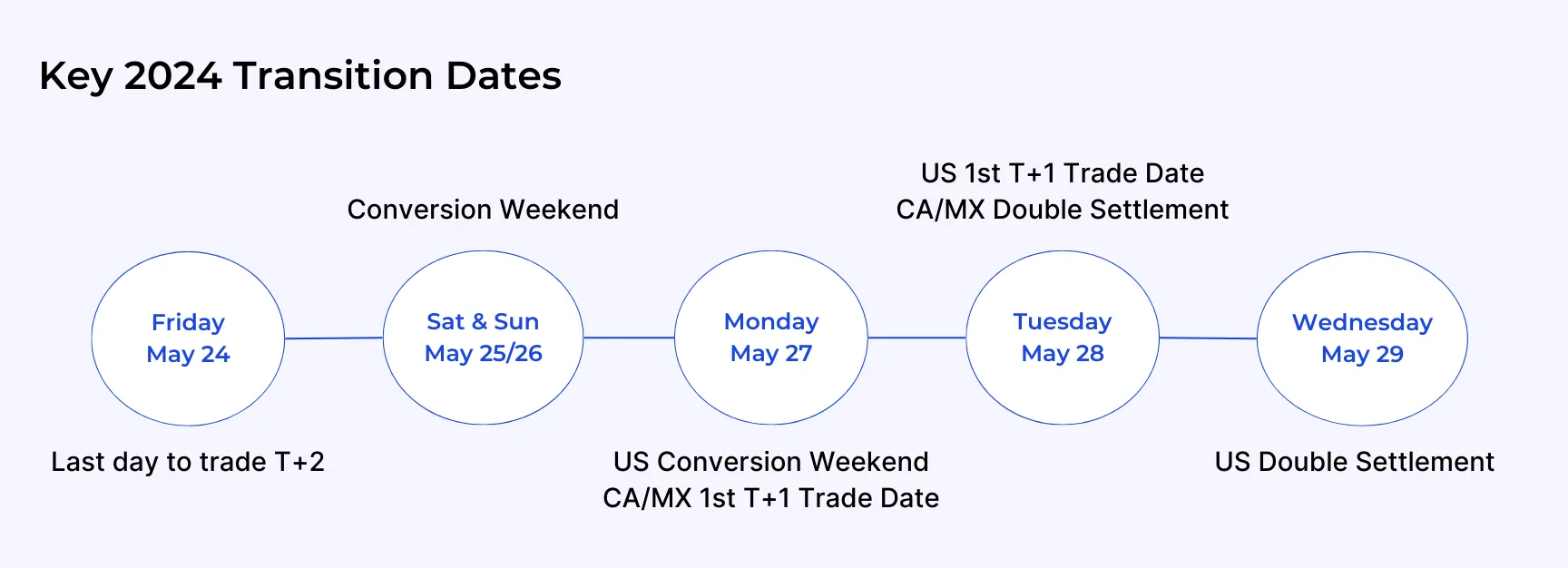

The financial landscape is on the brink of a significant transformation as the Securities and Exchange Commission (SEC) pushes for a compressed settlement cycle, moving from the current two business days after the trade date (T+2) to just one business day (T+1). With this rule set to take effect on May 28, 2024, market participants, especially on the buy-side, must prepare for a paradigm shift in their operations (i).

Both the buy- and sell-sides should prepare to combat vulnerabilities, including legacy technology and settlement delays. Industry participants must ensure their technology and internal operations - and those of their counterparties - can accommodate the change.

In a new whitepaper, Clear Street outlines:

- Required changes and their effective dates;

- Analysis of the potential issues industry participants could face in adapting to T+1;

- Details of the preparation associated with these challenges;

- And possible solutions.

SEC Final Rule Updates

The SEC's adoption of Rule 15c6-1 and Rule 15c6-2 is intended to provide numerous market benefits, including lower risk, improved efficiencies, increased liquidity, and reduced volatility.

These rules, effective on May 28, 2024, mandate a shortened standard settlement cycle, requiring broker-dealers to complete transactions on the first business day after the trade date (T+1) and to establish, maintain, and enforce written policies and procedures “reasonably designed” to ensure completion of trading processes as soon as “technologically possible” and no later than the end of the trade day.

Source: Citi

The Implementation Playbook

To aid market participants, industry organizations like the Securities Industry and Financial Markets Association (SIFMA), the Investment Company Institute (ICI), and The Depository Trust & Clearing Corporation (DTCC) have developed the T+1 Securities Settlement Industry Implementation Playbook (ii). This comprehensive guide outlines activities, timelines, dependencies, risks, and potential impacts during the transition.

Source: SIFMA

Product Impacts

The shift to T+1 settlement will reverberate across various financial products, affecting equities, ETFs, prime brokerage, and more. Critical areas impacted include allocations and affirmations, prime brokerage and clearing, securities lending, ETF creation and redemption, equity derivatives, exchange-traded derivatives, and listed options, foreign exchange, dual-listed products, and corporate actions.

Preparing for Change

The primary burden resulting from the transition is expected to fall on broker-dealers, clearing firms, and prime brokers. However, research points to an awareness gap within buy-side firms about the breadth of the impact and the effects on their clients. According to an SS&C poll, only 28% of investment firms have a detailed plan for T+1 (iii). Participants should give immediate attention to four critical vulnerabilities, including:

- Legacy Technology: Firms with outdated systems, especially those running batch cycles on mainframe technology, may be challenged to meet requirements.

- Counterparty Risk: The move to T+1 emphasizes the importance of counterparty preparedness, making it a significant risk for in-scope firms. Changes in trade file submissions and stop requirements should be assessed.

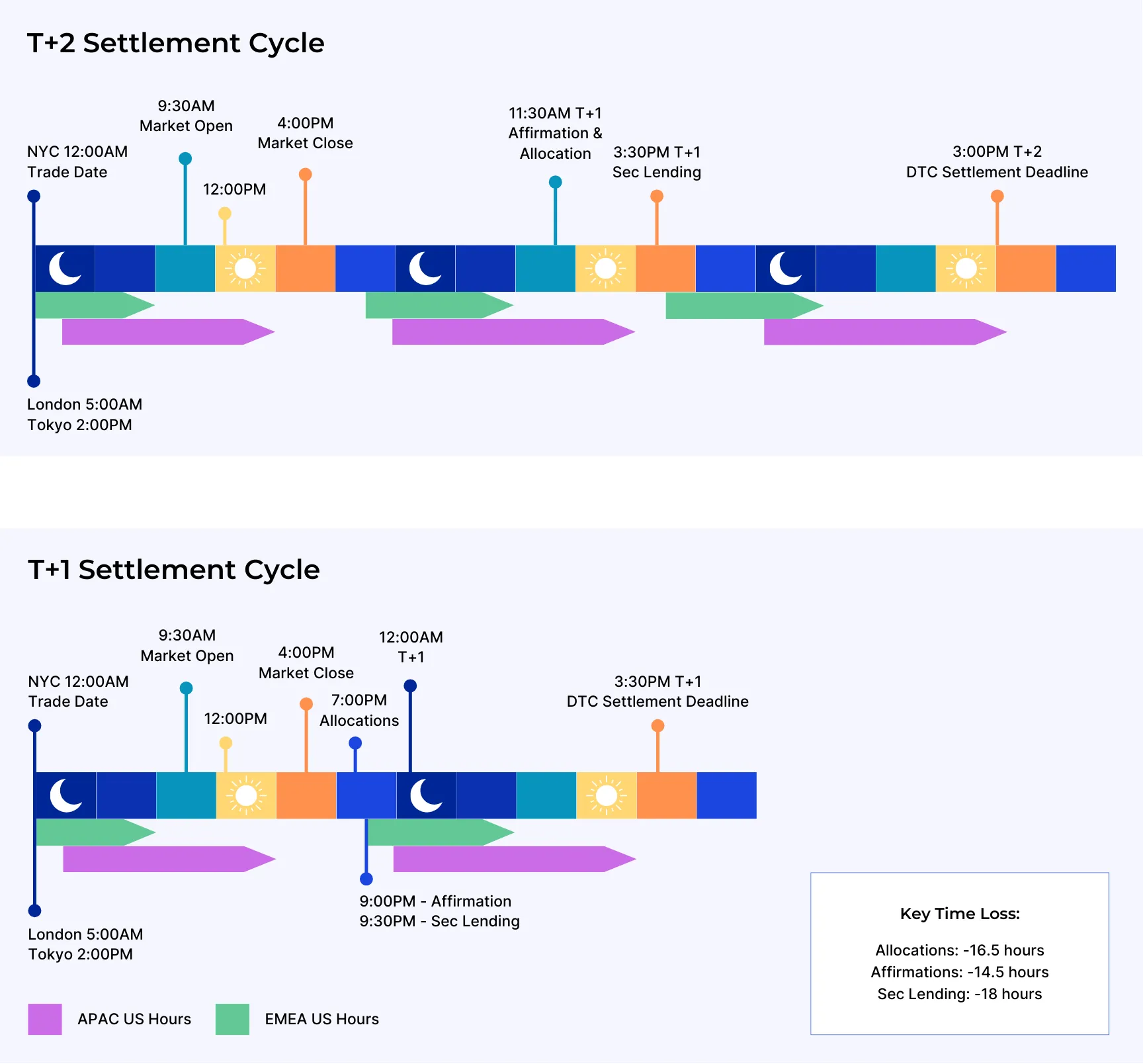

- Time Zone Synchronization: Post-trade time compression poses challenges for investors trading across time zones, increasing operational risk. Settlement mismatches and overnight funding requirements may arise.

- Higher Costs Due to Delays: Settlement fails become more challenging to resolve, leading to increased counterparty credit risk and negatively impacting market liquidity.

Solutions for a Seamless Transition

Financial institutions must replace manual processes with automation and system enhancements wherever possible. While T+1 intends to reduce systemic and operational risk, there is a likelihood of an increased risk in the short term - particularly for hedge funds and asset managers - if market participants fail to anticipate and adequately prepare for the transition.

- People-Based Solutions: In the short term, people-based solutions are crucial. The buy-side should work proactively with sell-side counterparties to align operational processes and broker policies. Resource allocation becomes essential, particularly for settling overseas trades and addressing risk and errors efficiently.

- Technology-Based Solutions: In the long term, technology-based solutions are imperative. Legacy technology must be upgraded to meet the demands of a compressed settlement cycle. System enhancements, including automation, real-time processing, and modern cloud-native infrastructure, are vital to success.

Cloud-Native Clearing, Settlement, and Custody for T+1

As organizations adapt to T+1, there's an opportunity for modernization. Proactive and comprehensive preparation, combined with technology and automation, is crucial for a seamless shift. Market participants must prioritize staying informed, adopting modern solutions, and collaborating with industry partners to navigate the complexities of the evolving financial landscape.

Clear Street embraces cloud-native infrastructure, resilient service orchestration, and event-driven real-time processing. Our technology stack reduces tedious reconciliation processes, optimizes settlement cycles, lowers costs, and minimizes risks. We’re prepared to shift operations to T+1 and to support our clients through the transition.

Get in touch with our team

Contact usClear Street does not provide investment, legal, regulatory, tax, or compliance advice. Consult professionals in these fields to address your specific circumstances. These materials are: (i) solely an overview of Clear Street’s products and services; (ii) provided for informational purposes only; and (iii) subject to change without notice or obligation to replace any information contained therein. Products and services are offered by Clear Street LLC as a Broker Dealer member FINRA and SIPC and a Futures Commission Merchant registered with the CFTC and member of NFA. Additional information about Clear Street is available on FINRA BrokerCheck, including its Customer Relationship Summary and NFA BASIC | NFA (futures.org). Copyright © 2024 Clear Street LLC. All rights reserved. Clear Street and the Shield Logo are Registered Trademarks of Clear Street LLC